Warren Buffet,

in the 2017 documentary,

Becoming Warren Buffett

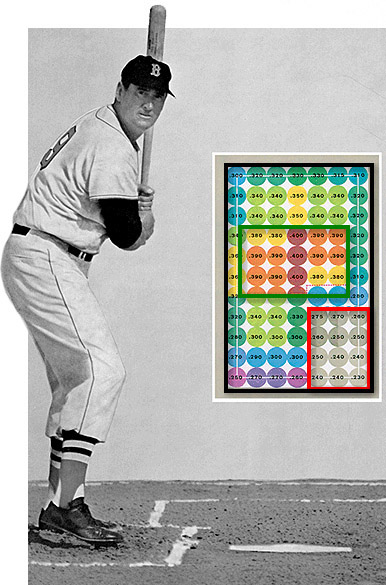

“I was genetically blessed with a certain wiring that’s very useful in a highly developed market system where there’s lots of chips on the table, and I happen to be good at that game. Ted Williams wrote a book called The Science of Hitting and in it he had a picture of himself at bat and the strike zone broken into, I think, 77 squares. And he said if he waited for the pitch that was really in his sweet spot he would bat .400 and if he had to swing at something on the lower corner he would probably bat .235. And in investing I’m in a ‘no called strike’ business which is the best business you can be in. I can look at a thousand different companies and I don’t have to be right on every one of them, or even fifty of them. So I can pick the ball I want to hit. And the trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum,’ ignore ’em. There’s a temptation for people to act far too frequently in stocks simply because they’re so liquid. Over the years you develop a lot of filters. But I do know what I call my ‘circle of competence’ so I stay within that circle and I don’t worry about things that are outside that circle. Defining what your game is – where you’re going to have an edge – is enormously important.”